irs.gov unemployment tax refund status

- One of IRSs most popular online features-gives you information about your federal income tax refund. Or apply online at wwwirsgov or call the IRS at 1-800-829-3676.

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Updated 3 minutes ago.

. Online Account allows you to securely access more information about your individual account. My unemployment actually went to my turbo card. Millions are still waiting for tax refunds for jobless benefits but the IRS is experiencing a backlog thats causing delays in getting money to these News Sections.

Check the status of your refund through an online tax account. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. 24 hours after e-filing.

In order to use this application your browser must be configured to accept session cookies. Wheres My Refund. Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45.

IRS collects taxes for the United States Government and offers the IRS e-File electronic filing service for individuals. Please ensure that support for session cookies is enabled in your browser. Since may the irs has issued more than 87 million unemployment compensation tax.

September 13 2021. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment.

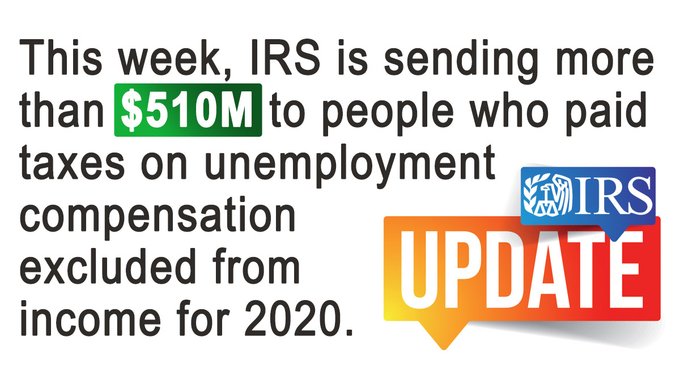

The 10200 is the amount of income exclusion for single filers not the amount of the refund. Using the IRS Wheres My Refund tool. The agency said last week that it has processed refunds for 28 million people who paid taxes on jobless aid before mid-March when Democrats passed the 19 trillion American Rescue Plan.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. You get personalized refund information based on the processing of your tax return. Unemployment tax refund status.

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. South Dakota House to vote on impeaching attorney general. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break.

The agency had sent more than 117 million refunds worth 144 billion as of Nov. IRS problems in the last 24 hours in Brooklyn New York The following chart shows the number of reports that we have received about IRS over the past 24 hours from users in Brooklyn and near by areas. The IRS effort focused on minimizing burden on taxpayers so that most people wont have to take any additional action to receive the refund.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The Internal Revenue Service and the Department of Treasury started sending out unemployment refunds to taxpayers who didnt claim their rightful unemployment. Another way is to check your tax transcript if you have an online account with the IRS.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. Wwwtaxnygov or contact the NYS Department of Taxation and Finance at 518-457-5431. Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are.

Unemployment benefits are generally treated as taxable income according to the IRS. The IRS will continue reviewing and adjusting tax returns in this category this summer. You cannot check it.

The IRS has just started to send out those extra refunds and will continue to send them during the next several months. Another way is to check your tax transcript if you have an online account with the IRS. People who received unemployment benefits last year and filed tax.

Check My Refund Status. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an.

The tool tracks your refunds progress through 3 stages. This is available under View Tax Records then click the Get Transcript button and choose the. The tool provides the refund date as soon as the IRS processes your tax return and.

For married individuals filing a joint tax return this. We base your tax. For individuals it excludes up to 10200 of their unemployment compensation from their gross income if their modified adjusted gross income is less than 150000.

Check For the Latest Updates and Resources Throughout The Tax Season. June 1 2021 435 AM. How do I check my Unemployment refund status.

This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. 4 weeks after you mailed your return. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

Under the American Rescue Plan Act of 2021 Americans who received unemployment compensation in 2020 received relief. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. Viewing your IRS account information.

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

Ad See How Long It Could Take Your 2021 Tax Refund. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

The Internal Revenue Service doesnt have a separate portal for. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

How To Find Your Irs Tax Refund Status H R Block Newsroom

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Tax Transcript Aving To Invest

Irs Tax Refunds Are Smaller Than The Irs Says They Ll Be For Some Fingerlakes1 Com

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

Irs Notice Cp81 Tax Return Not Received Credit On Account H R Block

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

Irs Tax Filing Season Starts Soon 5 Things To Remember Kron4

Fury As Major Tax Refunds Are Delayed For Millions Of Americans Because Irs Staffers Are Working From Home

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Forms What Is Form 1040 Sr U S Tax Return For Seniors Marca